|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

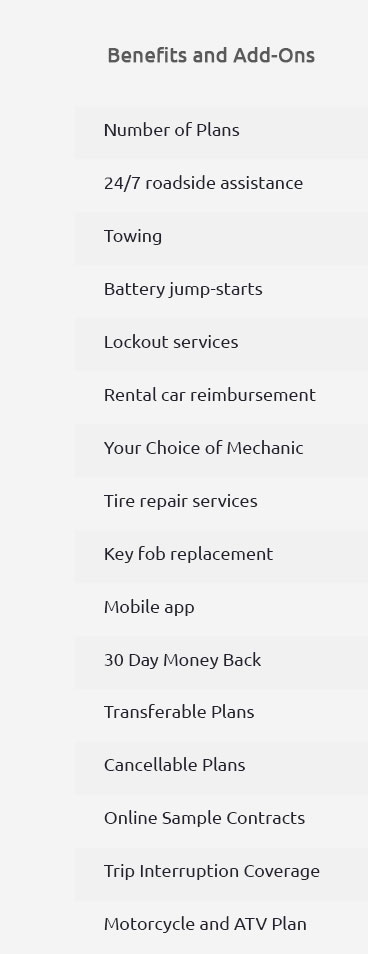

Car Liability Coverage: A Comprehensive GuideWhen it comes to protecting your vehicle and your finances, understanding car liability coverage is essential. This guide will walk you through the basics of what this coverage entails, its benefits, and how it relates to other forms of protection like extended auto warranties. Whether you're in bustling New York City or the serene landscapes of Montana, having the right coverage can provide peace of mind and save you money in the long run. Understanding Car Liability CoverageCar liability coverage is a crucial component of any auto insurance policy. It helps cover the costs if you're found legally responsible for a car accident, including damages to others' property and medical expenses for injuries.

Both types of liability coverage are typically required by law in most U.S. states, providing a financial safety net for drivers. Benefits of Car Liability CoverageHaving adequate liability coverage offers numerous benefits:

Extended Auto WarrantiesWhile liability coverage is mandatory, extended auto warranties provide additional peace of mind by covering repairs and replacements for vehicle parts. For example, a nissan remanufactured transmission warranty can protect against unexpected repair costs for your vehicle's transmission. Cost ConsiderationsThe cost of car liability coverage varies based on several factors:

It's important to shop around and compare policies to find the best rate for your needs. Comparing With Other ProtectionsConsider how car liability coverage fits with other protections like the fiat 500 extended warranty. Such warranties extend coverage for vehicle repairs beyond the manufacturer's warranty, offering comprehensive protection for your investment. Frequently Asked QuestionsWhat is the minimum liability coverage required in the U.S.?The minimum requirement varies by state. For instance, California requires $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage. How can I lower my car liability insurance premiums?You can lower your premiums by maintaining a clean driving record, increasing your deductible, bundling with other insurance policies, and exploring discounts for safety features or low annual mileage. In conclusion, understanding and choosing the right car liability coverage is a vital part of responsible vehicle ownership. By balancing coverage with cost and considering additional protections like extended warranties, you can ensure that you're well-prepared for any eventuality on the road. https://www.statefarm.com/insurance/auto/coverage-options/liability-coverage

Property Damage liability coverage (PD coverage). Helps pay for damage done during a covered event to another person's or company's property, as well as for the ... https://www.progressive.com/answers/liability-insurance/

Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage. https://www.libertymutual.com/insurance-resources/auto/auto-liability

If you're at fault for an accident, the liability part of your car insurance is what helps pay for the damages to the other ...

|